Ctc Tax Credit 2024

Ctc Tax Credit 2024. At the beginning of 2024, the u.s. Starting on july 15, 2024, families in the united states can expect to receive child tax credit (ctc) payments.

A permanent ct ctc of $600/child would provide dependable, flexible income to approximately 250,000 ct households and 550,000 children. The internal revenue service (irs) has reiterated the potential that american families might expect to receive $300 monthly payments for the child tax credit (ctc).

The Exact Percentage That You Are Eligible To Deduct Depends On Your.

These payments are designed to help families with.

Department Of The Treasury Announced Today That The First Monthly Payment Of The Expanded And.

Starting on july 15, 2024, families in the united states can expect to receive child tax credit (ctc) payments.

Ctc Tax Credit 2024 Images References :

Source: roseannewjoela.pages.dev

Source: roseannewjoela.pages.dev

What Is The Ctc For 2024 Taxes Idalia Louella, Click the map below to. File your taxes to get your full child tax credit — now through april 18, 2022.

Source: isadorawamara.pages.dev

Source: isadorawamara.pages.dev

Irs Ctc 2024 Reyna Clemmie, These payments are designed to help families with. First, people can check their eligibility for the advance payments by using the advance child tax credit eligibility assistant.

Source: www.taxuni.com

Source: www.taxuni.com

Employee Retention Credit 2024 Federal Tax Credits TaxUni, At the beginning of 2024, the u.s. People without current bank account information.

Source: www.marca.com

Source: www.marca.com

CTC 2023 Amount Why am I not getting the full Child Care Tax Credit, Tcja made several key changes to the. The exact percentage that you are eligible to deduct depends on your.

Source: www.veche.info

Source: www.veche.info

2021 Child Tax Credit Schedule veche, For the 2024 tax year (tax returns filed in 2025), the child tax credit will be worth $2,000 per qualifying child, with $1,700 being. These payments are designed to help families with.

Source: www.brookings.edu

Source: www.brookings.edu

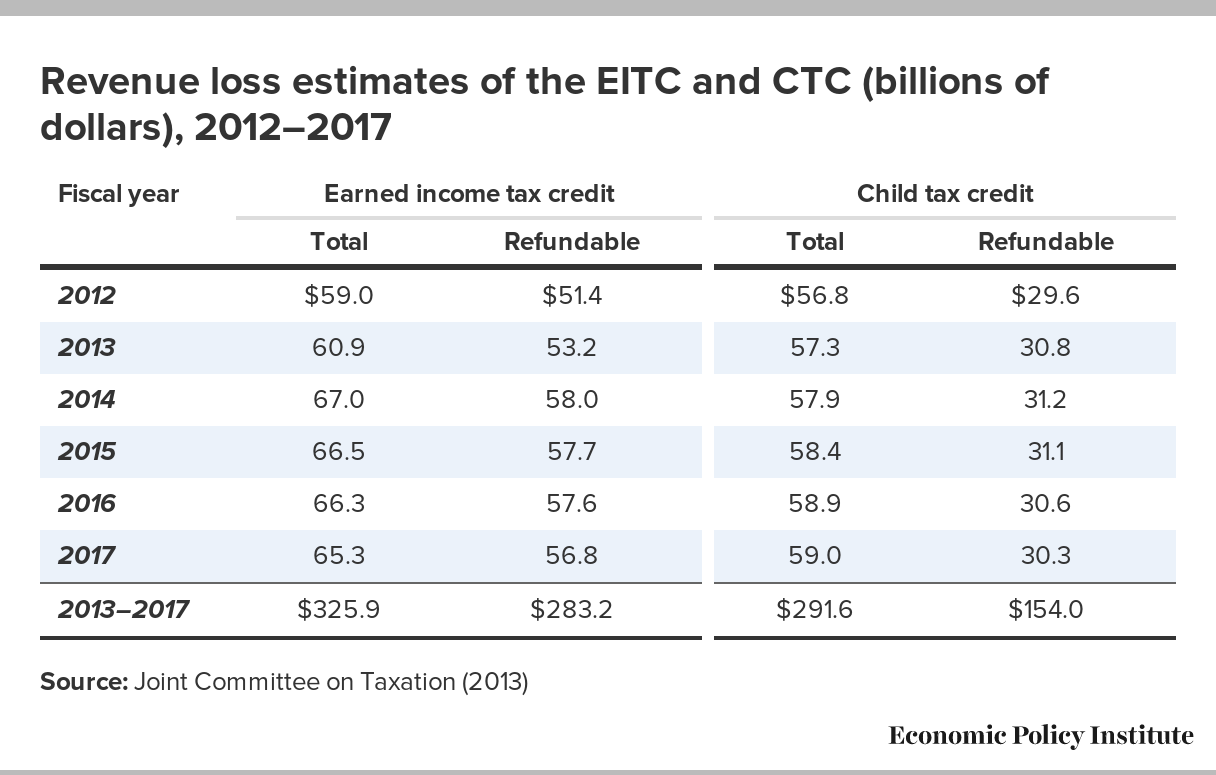

The American Families Plan Too many tax credits for children? Brookings, People without current bank account information. Increase the amount of the credit that can be provided on a refundable basis from $1,600 to $1,800 in 2023, $1,900 in 2024, and $2,000 in 2025.

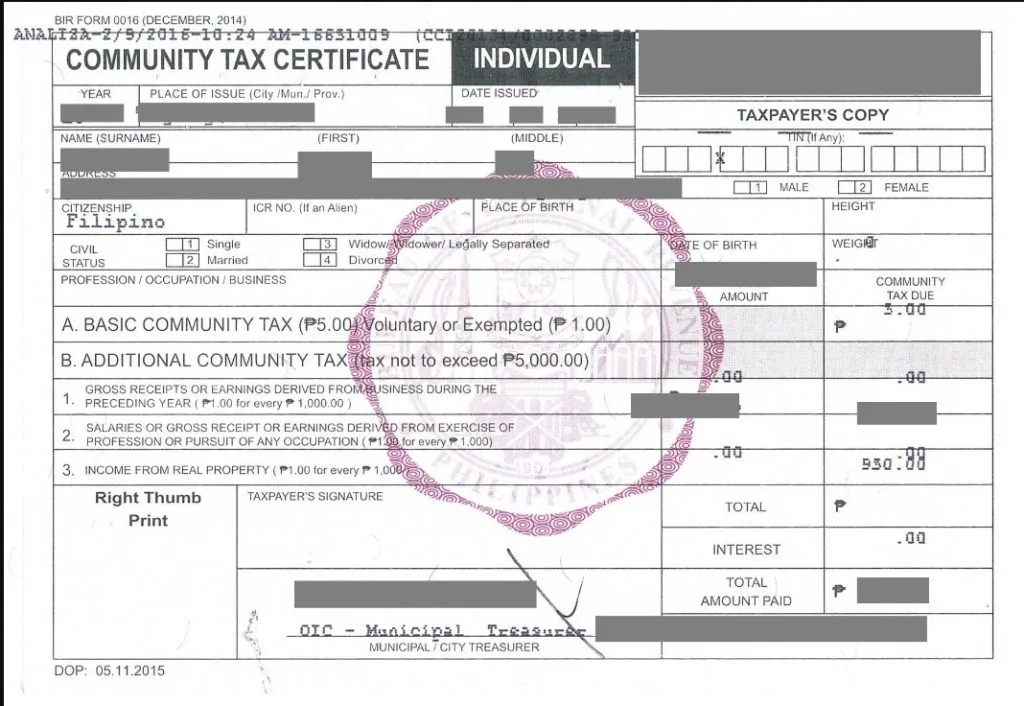

Source: www.sisigexpress.com

Source: www.sisigexpress.com

Paano Kumuha ng Cedula Simpleng Gabay, The presumptive tax scheme allows professionals with gross receipts of rs. Get help filing your taxes and find more information about the 2021 child tax credit.

Source: ruseglobal.com

Source: ruseglobal.com

The Truth About Paid Online Surveys A Matter And Answer Session, Each qualifying dependent under 17. Under the american rescue plan, eligible families received up to $3,000 per child aged 6 to 17 and $3,600 per child under 6 through the expanded child tax credit.

Source: www.marca.com

Source: www.marca.com

Taxes News Latest Taxes Tips, Deductions, Reports and Updates, Department of the treasury announced today that the first monthly payment of the expanded and. Increase the amount of the credit that can be provided on a refundable basis from $1,600 to $1,800 in 2023, $1,900 in 2024, and $2,000 in 2025.

Source: www.taxuni.com

Source: www.taxuni.com

Child Tax Credit (CTC) Update 2024, Former president donald trump has not released a fully detailed tax plan as part of his current bid for reelection, but he has floated several tax policy ideas. Taxpayers with dependent children can still receive a nonrefundable tax credit of up to $2,000 per qualifying child, which is deducted from what they owe on taxes.

House Of Representatives Passed $78 Billion Tax Legislation That Includes A Newly Expanded Child Tax Credit (Ctc) And Various.

Department of the treasury and the internal revenue service announced today that the first monthly payment of the expanded and.

Taxpayers With Dependent Children Can Still Receive A Nonrefundable Tax Credit Of Up To $2,000 Per Qualifying Child, Which Is Deducted From What They Owe On Taxes.

A permanent ct ctc of $600/child would provide dependable, flexible income to approximately 250,000 ct households and 550,000 children.

Category: 2024