Futa 940 Form 2024

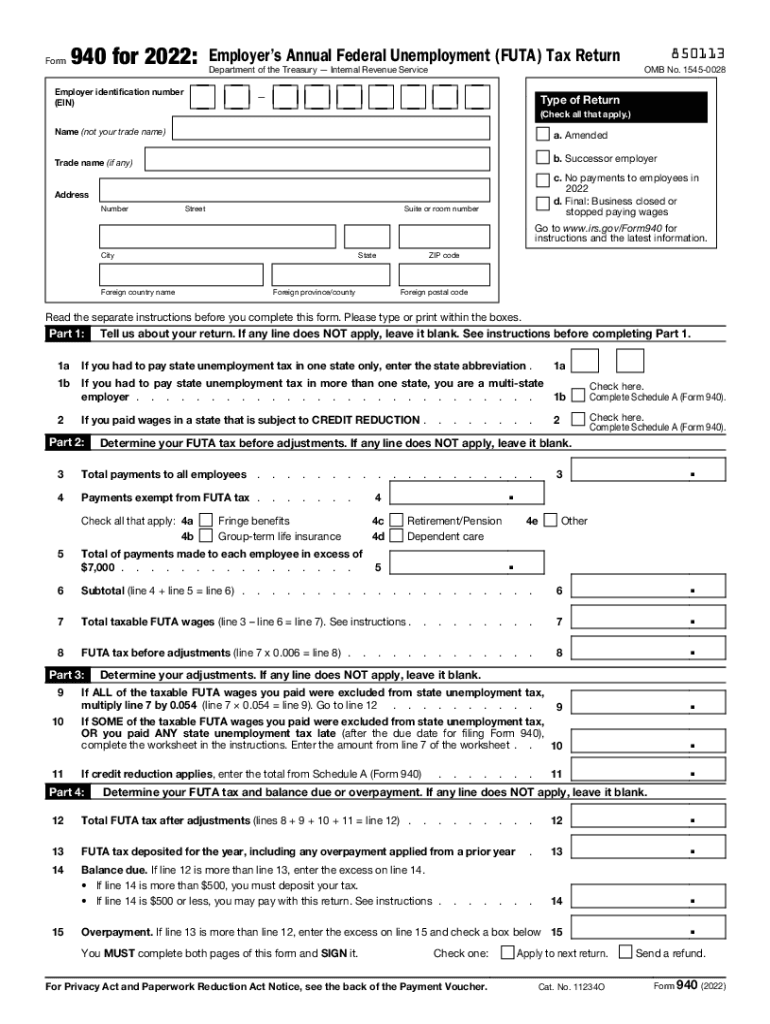

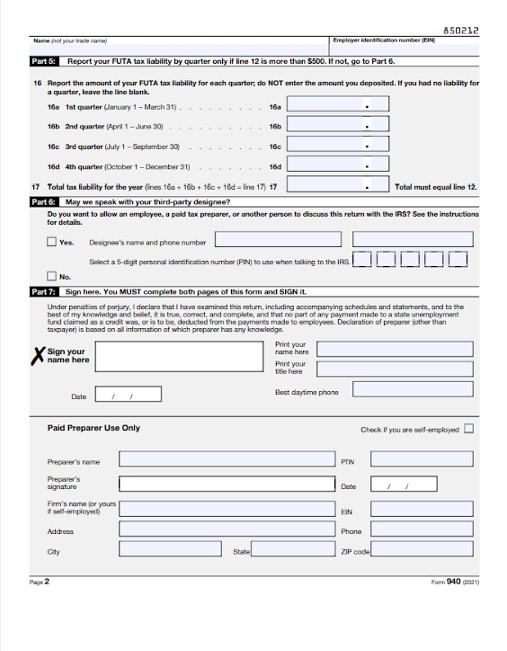

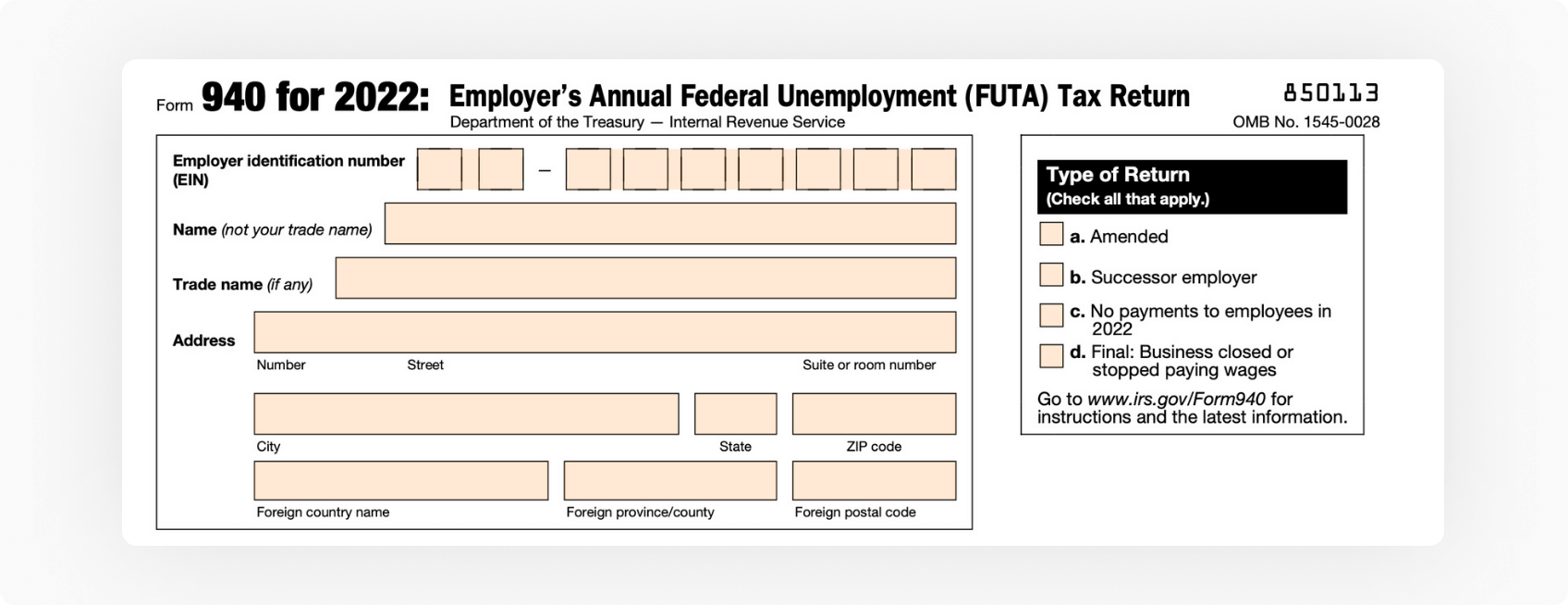

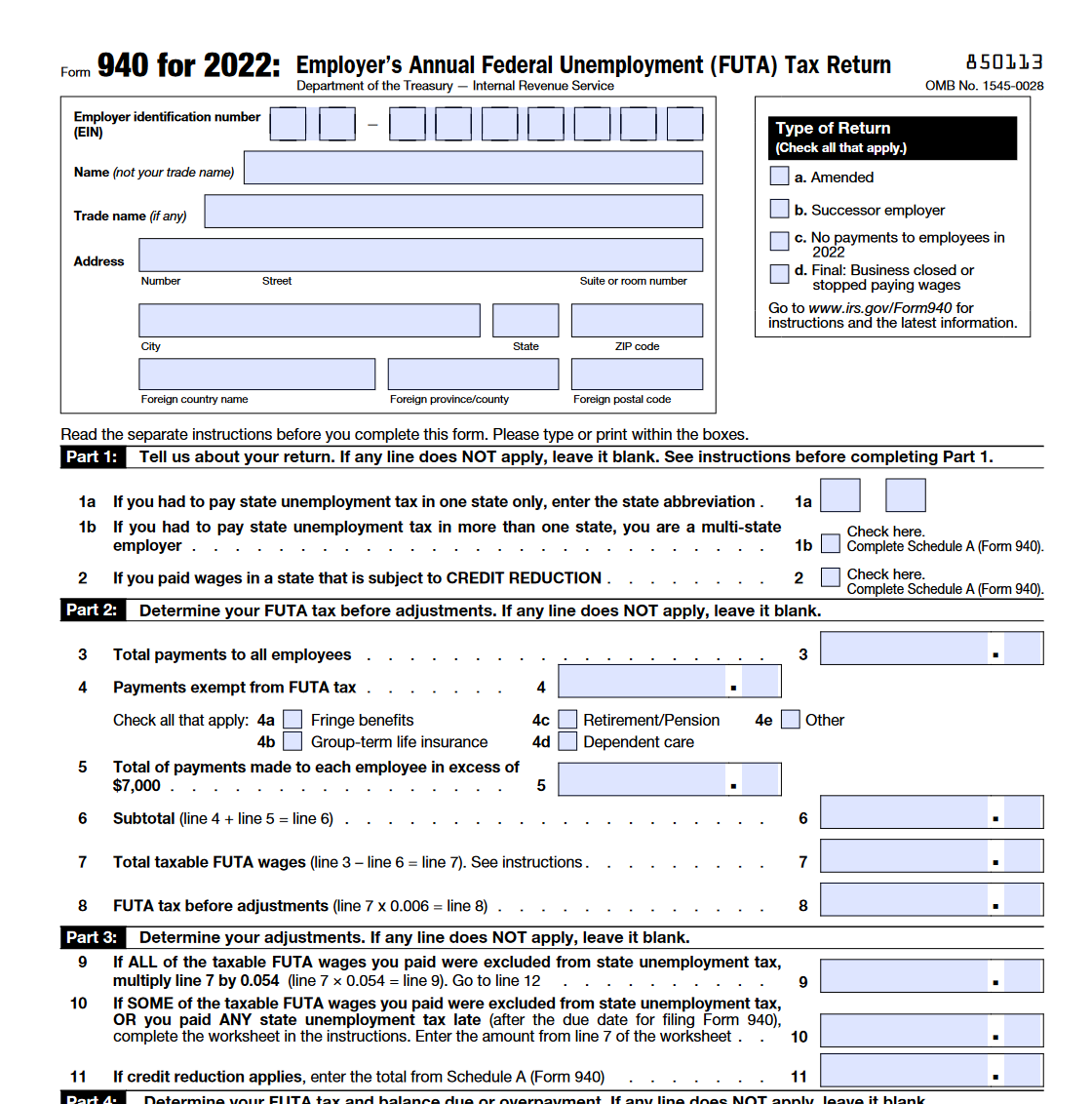

Futa 940 Form 2024. The 2023 tax year's form 940 submission date to the irs is january 31 st, 2024. Employer’s annual federal unemployment (futa) tax return department of the treasury — internal revenue service employer identification number.

The 2023 tax year’s form 940 submission date to the irs is january 31 st, 2024. On december 16, 2021 what is futa?

2024 Irs Form 940 And Form 941:

Monitor irs.gov for more information on.

However, The Irs Extends The Deadline For Those Who Have Made Futa Payments Regularly By 10 Days.

Click reports at the top menu bar and choose employees & payroll.

Form 940 Is An Irs Document Filed By Employers Once A Year To Report Their Federal Unemployment Tax Act (Futa) Tax Liability.

The due date for form 940 for the year 2023 is january 31, 2024.

Images References :

Source: www.signnow.com

Source: www.signnow.com

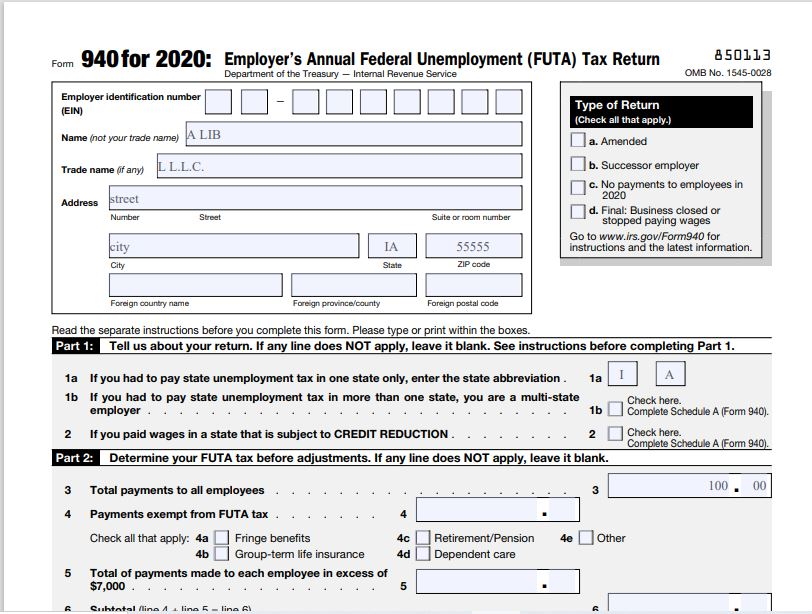

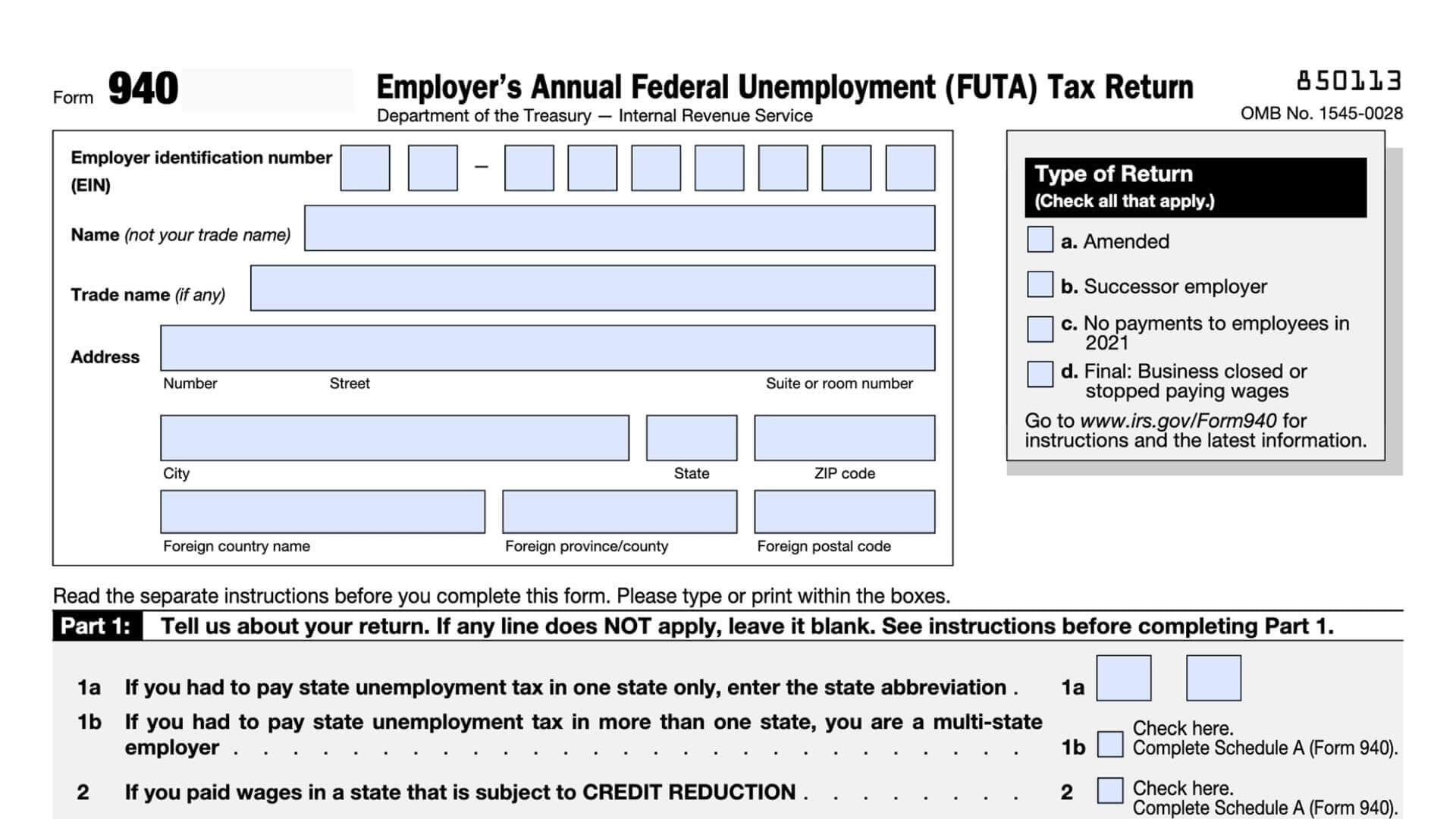

Fillable 940 20222024 Form Fill Out and Sign Printable PDF Template, The key differences between irs form 940 and form 941 lie in their. Form 940 has you enter information about the state unemployment taxes paid to show that you qualify for the 5.4% tax credit.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

FUTA Taxes & Form 940 Instructions, The due date for filing form 940 for 2023 is january 31, 2024. For budgeting purposes, you should assume a 0.90% futa rate on the first $7,000 in wages for all states with an additional percentage to be charged to cover the.

Source: blog.pdffiller.com

Source: blog.pdffiller.com

Form 940 instructions when to use and how to file, The 2023 tax year's form 940 submission date to the irs is january 31 st, 2024. Don’t forget about futa taxes

Source: www.youtube.com

Source: www.youtube.com

How to Fill Out Form 940 (FUTA Tax Return) YouTube, Form 940 and schedule a (form 940) are due by january 31, 2024 for tax year 2023. The credit and reduced rate are available by filing the form 940 for 2023.

Source: blanker.org

Source: blanker.org

IRS Form 940. Employer’s Annual Federal Unemployment (FUTA) Tax Return, 2024 irs form 940 and form 941: Futa tax is imposed on the first $7,000 of each.

Source: www.waveapps.com

Source: www.waveapps.com

What is IRS Form 940?, The standard futa tax rate is 6.0% of the first $7,000 of wages that are subject to futa. However, the irs extends the deadline for those who have made futa payments regularly by 10 days.

Source: www.youtube.com

Source: www.youtube.com

1How to Complete Form 940 for 2021 Employer’s Annual Federal, Form 940 is an internal revenue service (irs) document that lets employers report any federal unemployment tax act (futa) tax payments they’ve made over the. Most employers receive a credit on their futa taxes of 5.4%, leaving.

Source: gusto.com

Source: gusto.com

What Is Form 940? When Do I Need to File a FUTA Tax Return? Ask Gusto, The key differences between irs form 940 and form 941 lie in their. Information about form 940, employer's annual federal unemployment (futa) tax return, including recent updates,.

Source: ninasoap.com

Source: ninasoap.com

How to Complete 2020 Form 940 FUTA Tax Return Nina's Soap, Don’t forget about futa taxes What this means is that in january,.

Source: www.zrivo.com

Source: www.zrivo.com

940 Form 2023, Monitor irs.gov for more information on. For budgeting purposes, you should assume a 0.90% futa rate on the first $7,000 in wages for all states with an additional percentage to be charged to cover the.

The Due Date For Filing Form 940 For 2023 Is January 31, 2024.

In new jersey, where no credit reduction exists, the effective futa tax rate is 0.6% for.

If This Date Lands On A Weekend Or A Public Holiday, The Deadline Is Extended To The Next.

Information about form 940, employer’s annual federal unemployment (futa) tax return, including recent updates,.

Under The General Test, You're Subject To Futa Tax On The Wages You Pay Employees Who Aren't Household Or Agricultural Employees And Must File Form 940,.

If you deposited all the futa.

Category: 2024